Insolvency practice has become global and dynamic in nature to the extent that, key players in the insolvency practice require continued training and sensitization about new critical insolvency practical aspects.

Business has been identified as one of the biggest lifebloods of Uganda’s economy. It creates jobs, increases productivity, and generates growth.

Restructuring and insolvency is an essential part of this system and is vital for ensuring that Uganda maintains its reputation as one of the best places in the East African Region to do business.

To support the strengthening of the Judiciary’s and Insolvency Practitioners’ capacity to handle and resolve insolvency disputes that are brought before respective courts, the Uganda Registration Services Bureau (URSB) together with Judicial Training Institute (JTI) organized a conference for Judicial Officers and Insolvency Practitioners under the theme ‘Emerging Trends and Practices: Building a Resilient Insolvency Regime’.

The two-day conference presented a platform to examine the new global insolvency aspects post the COVID-19 experience.

The discussion equipped key players with the evolved innovative international insolvency best practices required for Uganda’s dynamic economy which is recovering from the pandemic.

A panel of industry experts shared their views on what lies ahead for businesses and the practice of insolvency in a changing economic and regulatory environment.

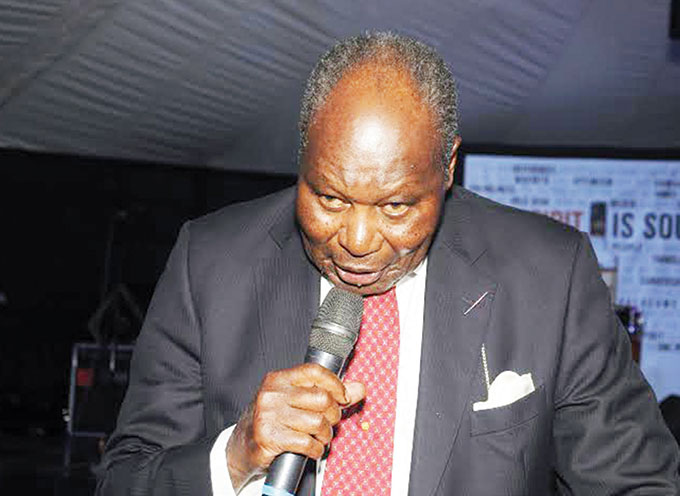

Speaking at the conference, Hon. Norbert Mao, Minister of Justice & Constitutional Affairs said the government had a deliberate effort to support financially ailing businesses.

“It is essential to strengthen our capacity to handle and resolve insolvency matters whether before, or outside courts and where appropriate, support the revival of insolvent entities instead of dissolution,” Hon. Mao said.

URSB Registrar General, Mercy K. Kainobwisho said Uganda’s economy was getting increasingly formalized, but also, business failure had become a reality.

“Insolvency law has a breadth of options which if well implemented can reduce the rate of business failure, especially in the post COVID-19 pandemic era” She added.

The Board Chairman, URSB, Ambassador Francis Butagira said following of the enactment of the Insolvency Act 2011 and the subsequent amendment of 2022, key provisions addressing the emerging trends of insolvency law practice were introduced. “A solid insolvency regime attracts investors into the country” he added.

In furtherance of the insolvency practice, URSB has established an annual Insolvency & restructuring Journal of Uganda, which was also launched as part of the repository of knowledge and experiences of Insolvency Practitioners, Academia and other stakeholders in the insolvency regime.