Bank of Uganda has hosted a high-level delegation from the Bank of Namibia for a week-long benchmarking visit aimed at strengthening regional cooperation on oil and gas resource governance.

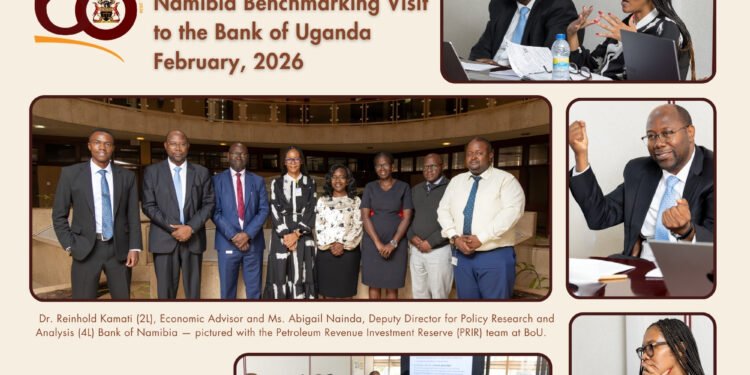

The delegation, led by Dr Reinhold Kamati, Economic Advisor and focal person on Oil, Gas and Hydrogen, and Ms Abigail Nainda, Deputy Director for Policy Research and Analysis, visited Uganda at the request of the Governor of the Bank of Namibia to study the country’s preparations ahead of first oil production expected later this year.

During the visit, the Namibian team engaged with senior leadership and technical experts at the Bank of Uganda on key aspects of petroleum revenue management and macroeconomic stability.

Central to the discussions was Uganda’s Sovereign Wealth and oil revenue management framework, including the mandate, governance structure, and transparency safeguards guiding the Petroleum Revenue Investment Reserve.

Officials also examined the country’s institutional readiness to manage oil inflows once production begins.

The exchange further explored macroeconomic and external sector dynamics, with a focus on exchange rate developments, trade statistics, and real sector performance during and after the onset of oil production.

Discussions highlighted strategies to mitigate volatility and maintain macroeconomic stability in resource-rich economies.

Financial markets and reserves management also featured prominently. Technical teams assessed the potential impact of oil operations on foreign exchange reserves, domestic liquidity, and overall market stability, drawing lessons from Uganda’s policy planning and coordination mechanisms.

Beyond the central bank, the delegation held engagements with key national stakeholders, including the Ministry of Finance, Planning and Economic Development, the Petroleum Authority of Uganda, the Ministry of Energy and Mineral Development, the Uganda National Oil Company, and the Uganda Bankers’ Association.

The visit underscores growing regional collaboration among African central banks as countries prepare to manage natural resource wealth responsibly.

As Uganda moves closer to commercial oil production and Namibia advances its own hydrocarbon prospects, policymakers say such exchanges are critical to building institutional capacity and safeguarding long-term macroeconomic stability across the continent.