Uganda’s ballooning public debt, which has now crossed the Shs106 trillion mark, is sparking deep concern among economists who warn that the country’s borrowing habits are steadily undermining essential public services like health, education, and infrastructure.

With the 2026 general elections on the horizon, government spending has shifted into high gear—fueled in part by political promises and campaign pressures. But this fiscal expansion comes at a cost: more money is now being used to repay old debts, leaving less for service delivery.

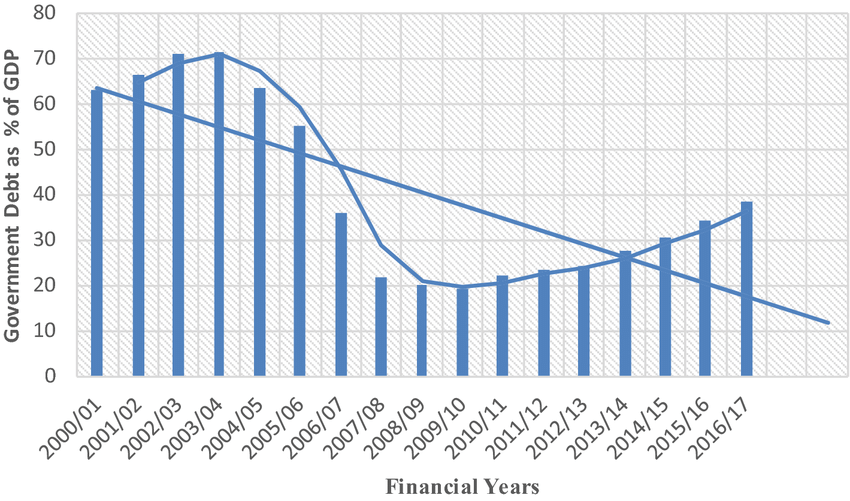

Projections for the Financial Year 2025/2026 show the debt-to-GDP ratio hitting 53.34%, surpassing the 50% ceiling outlined in Uganda’s Charter of Fiscal Responsibility. The Ministry of Finance estimates that the government will borrow an additional Shs34.3 trillion to help finance the Shs72 trillion national budget.

“Uganda is drifting deeper into a debt trap,” warns Dr. Fred Muhumuza, a senior economist. “We’re borrowing to pay off old loans while basic services suffer. It’s an unsustainable path.”

As of December 2024, Uganda’s public debt stood at Shs106.9 trillion—comprising Shs53.75 trillion in external debt and Shs53.22 trillion in domestic debt. This marks a 9% jump from the Shs96.6 trillion recorded the previous year.

Economists attribute much of the current fiscal stress to election-driven expenditure. Political leaders are under pressure to deliver on long-promised infrastructure, social services, and jobs, prompting a spree of unbudgeted or fast-tracked projects aimed at voter appeasement.

“The challenge,” Dr. Muhumuza says, “is that spending is being guided more by politics than long-term planning. That’s a recipe for economic strain, not resilience.”

Experts are urging government to impose stricter borrowing controls, boost domestic revenue collection, and prioritize transparency in debt management. They caution that unless urgent reforms are implemented, the country risks crowding out funding for critical sectors that directly affect livelihoods and long-term growth.

“Debt should fund transformative projects—not short-term political gains,” said one analyst. “Otherwise, we’ll end up servicing loans with no clear returns while schools lack chalk, hospitals lack drugs, and roads remain unpaved.”

The warning comes amid a growing debate over Uganda’s economic trajectory, with fiscal watchdogs calling on Parliament to demand greater accountability from the Executive before approving additional borrowing.