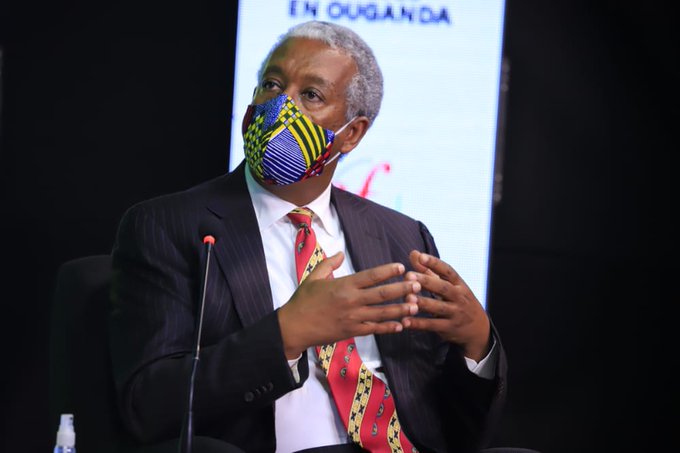

The Managing Director of the National Social Security Fund (NSSF) Uganda, Patrick Michael Ayota, has outlined a new strategy aimed at enhancing service delivery and internal efficiency, anchored on three key pillars: safety, convenience, and empowerment.

Speaking during a strategic engagement, Ayota acknowledged that the Fund had previously lacked effective systems to deal with member concerns, prompting a deliberate shift in operational focus.

“We realized that critical empowerment was important because we didn’t have the room to deal with our members’ issues,” Ayota said.

According to Ayota, the new strategy not only targets improving the member experience but also prioritizes staff welfare and organizational alignment. He emphasized that investing in staff morale translates directly into improved service for NSSF clients.

Sometimes, we must forget the customer and focus on the staff. When staff are happy, they will serve customers better,” he noted.

Ayota said the Fund aims to deliver at least 200 basis points (2%) annual growth in member returns, starting from a baseline set in August 2022. This forms part of an outcome-based approach that links strategic intent with measurable value.

The NSSF has also adopted a cross-functional project management model, involving teams from IT, marketing, customer service, commercial, and risk departments. The aim, Ayota said, is to ensure every department plays a role in tailoring products and services that meet member expectations

“You need someone high enough to own the project, to push back and secure resources when needed. That’s why we chose a senior executive from marketing to lead,” he explained.

To further streamline execution, Ayota revealed that the Fund’s Project Management Office has been embedded within the Strategy Office, allowing for closer alignment between long-term plans and on-the-ground delivery.

The shift comes as NSSF responds to growing demands for digitization, operational transparency, and better returns for its more than two million members.

The Fund, which manages assets worth over UGX 18 trillion, has been undergoing strategic reforms following earlier leadership changes and public scrutiny over governance and member payouts.