Ugandans who have risen to fame by making anything about everything trend on the microblogging site, Twitter are in hiding after tycoon Hamis Kiggundu aka Ham lost a court case against Diamond Trust Bank (DTB).

On Wednesday, the Court of Appeal ruled that a Kampala businessman, Ham was wrongly awarded the Shs120 billion compensation by the Commercial court last year.

In a unanimous decision of justices Kenneth Kakuru, Christopher Madrama and the DCJ Richard Buteera, the case file involving Ham and Diamond Trust Bank has been sent back to the Commercial Court for a retrial after establishing that the High court judge Henery Peter Adonyo did not address himself on the merits of the case before deciding it on a point of law.

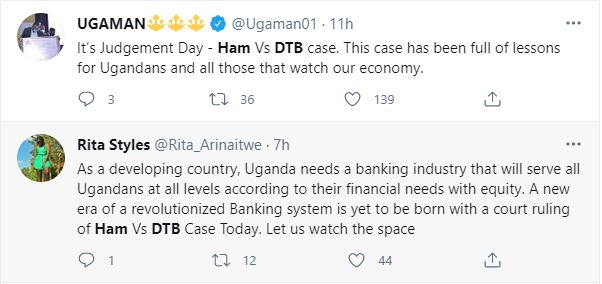

Prior to the ruling on Wednesday, like they always do, Ham ‘hired’ influencers took to the twitter streets to build to put in their final arguments for the young tycoon, only to lead him to legal harm’s way!

Now, majority of them are nowhere to be seen on the streets with the Ham v DTB” vanishing in thin digital air.

Ham has been blamed by experts for resorting to use Twitter influencers instead of hiring good lawyers to argue out his case as courts dont depend on social media emotions.

“The Ham vs DTB case simply shows that no matter how ‘rich’ you are, you need to hire experienced communications professionals for as long as you run big businesses. Wadde wasoma oba tewasoma…” a one Brian Kyeyune M* tweeted.

Some have joked that as DTB got the services of top lawyers, Ham resorted to the famous ‘public court’ with twitter influencers as his legal team, a move they say ended in premium tears.

SCREENSHOTS OF HAM’S ONLINE GENERALS

BACKGROUND

Wednesday’s orders are rising from an filed by Diamond Trust Bank contesting an order by the commercial court to pay Kiggundu shs120 billion after the Commercial court found out that its partner Diamond Trust Bank Kenya, from whom Kiggundu borrowed the money, had no operating licence to carry out business in Uganda.

The decision was based on a suit filed by Kiggundu, through his companies; Ham Enterprises and Kiggs International, against DTB Bank. He accused the banks of illegally taking out more than shs120 billion from his bank account in Uganda.

Kiggundu stated that between 2011 and 2016 his companies were given loans totalling shs41 billion by both DTB Uganda and Kenya and he deposited with them several properties as security.

However, Kiggundu said that as his companies were repaying the loans, he realized shs34 billion was illegally removed from his shillings account and USD 23 million from the dollar account.

In the aftermath, Commercial Court Judge Adonyo agreed with Kiggundu and ruled that the credit facilities offered by DTB-Kenya to Kiggundu were illegal since the bank is not licensed to carry out the financial institution business in Uganda.