Last month I waded into the raging debate about the valuation of the sale of Crane Bank Assets to dfcu.

The bone of contention then was that Bank of Uganda had undervalued Crane Bank and dfcu had bought it on the cheap.

The numbers bore themselves out and it was clear in that article that dfcu retired from that transaction with a challenge to make the assets it had acquired produce an acceptable return for its shareholders.

In most deals done under the hammer of a regulator, there will be winners and losers. The reason is that the regulator’s intention is not to maximize value for any party in the deal but the pursuit of broader sector goals.

BoU in this case was focused on ensuring short to medium term stability. Below, we examine the result of the transaction for some parties and make a judgement on who may have won or lost.

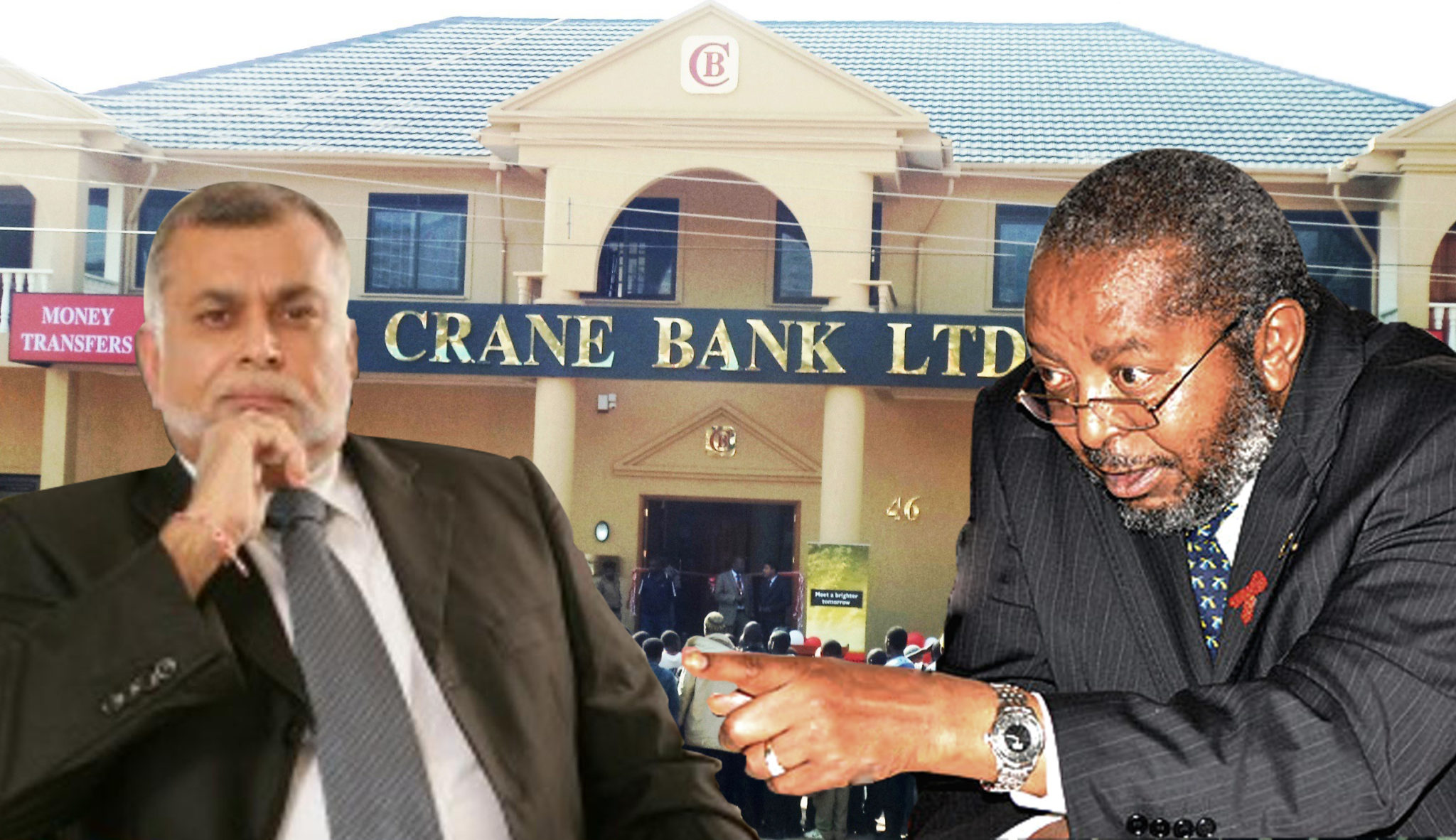

Sudhir Ruparelia founded and ran the Bank for over two decades, growing it into the 3rd largest Bank in Uganda. Crane Bank became the flagship entity in his business empire and was instrumental in elevating Sudhir, his family and some of his other businesses.

He could, through the bank, access financial resources to build his real estate empire. Over the last 10 years, the family consolidated their real estate and hospitality businesses.

So when BoU injected over UGX 450bn into Crane Bank after it became insolvent, it ensured that his real estate business remained largely intact.

If Sudhir had continued to own and run the Bank under his empire, given the high level of Non- Performing Loans which starved Crane Bank of cash flow, he would have been compelled to inject at least US$ 100 million in capital to continue trading.

Such an injection would possibly have constrained his ability to grow and sustain the rest of his business empire. In an uncanny way, by letting the Bank collapse and not diverting capital from his other businesses, the first winner in the resolution of the Crane Bank transaction is Sudhir.

In a recent article by Dr. Louis Kasekende, the Deputy Governor indicated that the primary objective of Bank of Uganda is to ensure financial stability.

Delay in the resolution of Crane Bank and allowing it to proceed to liquidation would have undermined public confidence and exposed many businesses to collapse.

In the time it was placed under statutory management, BoU kept Crane Bank afloat, ensured system-wide stability and found a buyer for the assets and liabilities of Crane Bank.

The buyer, dfcu, had the ability to assume the assets and liabilities, pay the depositors on demand, integrate Crane customers with its own, take over the branch network and assimilate most Crane staff.

This bold decision by BoU ensured a seamless transfer process, maintenance of sector stability and restoration of confidence.

Based on the recently released 2017 accounts, dfcu posted good results with a much stronger capital base and balance sheet.

The industry Non Performing Asset level also dropped from double digits in 2016 to 5.5% by the end of 2017, substantially on account of this transaction. For their firm and swift action to resolve the Crane Bank situation, Bank of Uganda are also winners.

The resolution of Crane required dfcu to take over some assets and assumption of all customer deposits and other liabilities.

Trouble usually arises in business combinations, when there are compatibility issues between the two sets of staff, a lower service level to the new customers of the acquiring bank or insufficient capacity in the combined entity to satisfy the new body of customers.

Ex-Crane customers have had full access to their accounts and funds during the transition and have continued as customers to dfcu. The third winner in this transaction are the Crane Bank depositors, borrowers and staff integrated into dfcu.

dfcu is now rated among the top three with a larger balance sheet and countrywide presence.

If dfcu can realize the Fair Value of the assets included on its balance sheet over the coming five years, the shareholders will enjoy a decent return on their investment. The gauntlet has been thrown down at

Management to optimize the Banks’ new position in the market to grow shareholder value. It is imperative that dfcu mines the value of the customer relationships and bad debts over the coming years so as to fully realize the benefits of this transaction. For the opportunity gained, dfcu and its shareholders also rank as winners.

The dfcu/Crane Bank transaction has enriched the Ugandan capital markets and financial reporting landscape, as it provided a real-life accounting experience which is accessible to the public by virtue of dfcu being a listed entity and showed how a listed company can use a capital markets transaction to raise funds to pay for an acquisition.

The previous significant merger transactions like that of Airtel and Warid were between private entities that have no obligation to publish results.

In a sense, the publication of dfcu’s results reflecting the transaction is a welcome contribution by dfcu to reading material on the application of International Financial Reporting Standards.

This landmark transaction is a reference point for regulators at large who have struggled with resolution of delinquent Banks and will for a long time offer invaluable practical training material.

For the learning opportunity, the accounting profession and the capital markets are ranked as winners.

Finally, what is debatable is whether the taxpayer was a winner or a loser. The resolution of Crane required an injection of close to UGX 500 billion. Of this, UGX 200 billion is to be paid by dfcu.

The balance was from taxpayer shillings, which were diverted from a number of government priorities. It can also be argued however that the UGX 300 bn was a small price to pay to assure banking sector stability.

The jury is therefore still out on whether the taxpayer is a winner or a loser.