The leadership of Hoima City is urging property owners and landlords to seek recourse if they are uncomfortable with the property tax rates applied to their properties. This call was made by Mr. Edward Isingoma Amooti, the Speaker for Hoima City Council, during an engagement with property owners.

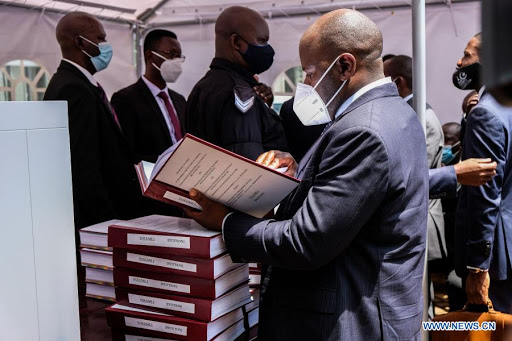

The engagement event took place on 31st August 2023 at at Buffalo Hotel in Hoima City. The event was part of a larger campaign titled; “Services and Fair Tax for Property Owners” coordinated by RippleNami Uganda with the support of USAID under the Domestic Revenue Mobilisation for Development (DRM4D) initiative.

Mr. Isingoma emphasized that as the City Council deliberates on resource generation for the city, they also consider how to effectively and wisely allocate these resources for service delivery, and they value the input of taxpayers.

“To achieve these objectives, we need to focus on three things: fair assessment of the tax, humane tax collection methods, and ensuring that tax collections translate into services for the people,” he explained.

Mr. Isingoma stressed the importance of reducing the gap between leaders and taxpayers through ongoing and meaningful engagement. He encouraged those who are uncomfortable with the property tax to seek redress through the appellant courts, which have been made available for this purpose.

“These are your offices. Tax collectors and council leaders are your servants and must involve you—it’s your right. The city is open for you to come and talk to us. We have an appeal system, so if you’re not satisfied with the tax assessment, the system can provide checks and balances, especially if the collection methods are not humane,” Mr. Isingoma stated.

Some property owners have expressed reservations about property tax, with many claiming they don’t understand how the tax rates are determined and lack information about this specific tax.

Donanto Kasigazi, the Deputy Resident City Commissioner for Hoima City, acknowledged a lack of sensitization, particularly for landlords, when it comes to property tax.

Property rates represent one of the largest revenue streams for local governments, with at least 85 percent of the proceeds invested in projects such as road and drainage construction and maintenance, street lighting fees, and security improvements.

It’s important to note that residential owner-occupied properties are exempt from property rates. Property rates are only levied on properies used for business purposes, including rental businesses. However, a property does not have to be a rental for property rates to apply, rates apply to any structure being used for business, even owner-occupied shops, for example.